Setup for Prepaid Parts Inventory Paid by Credit Card

Scenario:

-

Parts are ordered and received

-

The receiving document/packing slips go to the CSR team

-

CSR team receives the parts supplier invoices and will cost the PO

-

CSR will enter the AP quick pay for each invoice as part of the costing process (do not set the supplier to auto launch into AP)

-

Parts supplier is paid by company credit card

-

Credit card is then paid for by AP quick pay out of the company bank account

How it will flow:

Setup

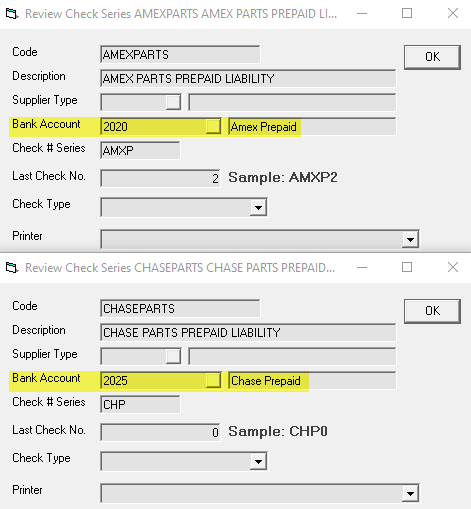

You will need a check series for each credit card that will be used to pay the parts supplier; this is setup in Tools > System Maintenance > Tables > Check Series. The GL code will be a prepaid parts liability account for each credit card check series. If all parts suppliers are paid for by one credit card, you only need to set up one parts prepaid check series.

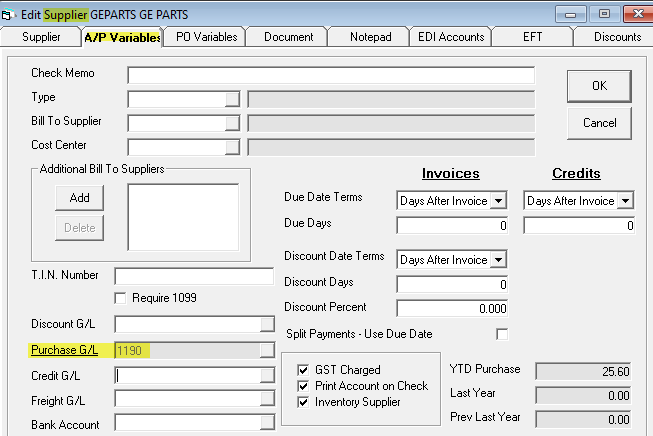

Add the parts inventory GL code to the parts supplier on the AP Variables tab.

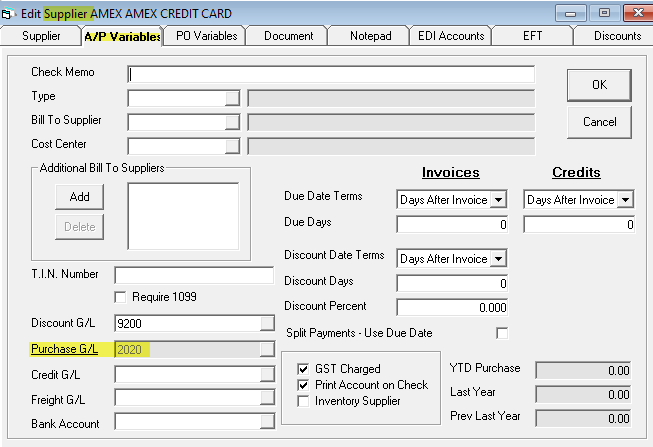

Add the prepaid credit card GL code to the credit card supplier on the AP Variables tab. The credit card supplier will potentially have several GL codes listed here for all the expenses being paid for by credit card.

Process

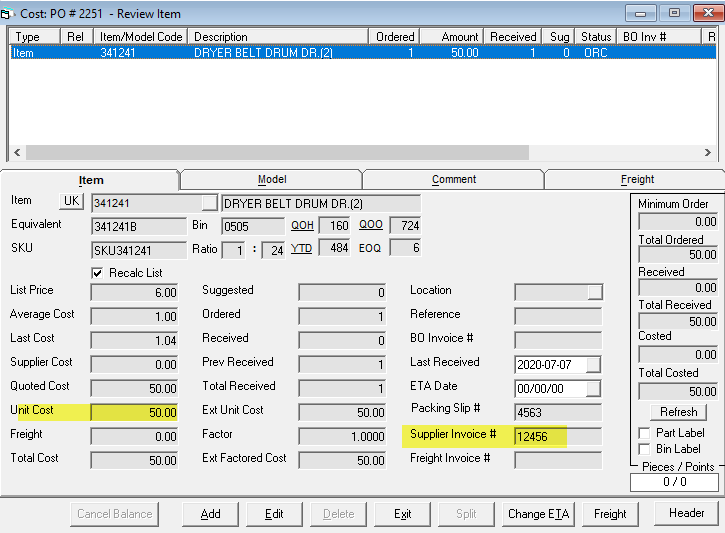

CSR costs the PO ensuring the unit cost is correct and the supplier invoice number is entered.

You can cost all POs and then go back and enter the Quick Pay for each invoice or cost each PO and create the Quick Pay after each costing.

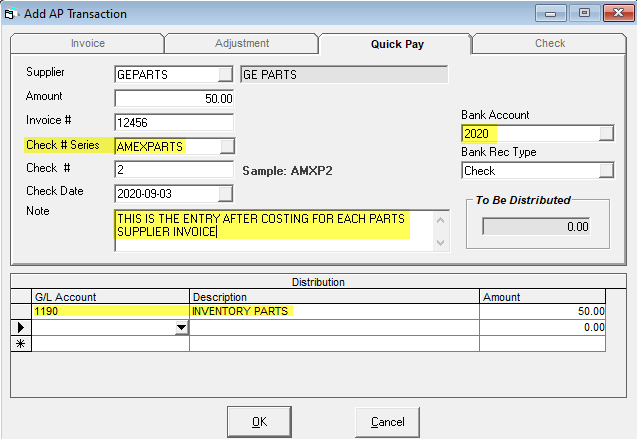

CSR to create a Quick Pay in AP for each invoice using the prepaid credit card check series. The two sides of this entry are the prepaid parts liability GL and distribution to the parts inventory asset GL.

To make for better tracking, there should be a Quick Pay for each supplier invoice number provided by the supplier that was used in costing cycle.

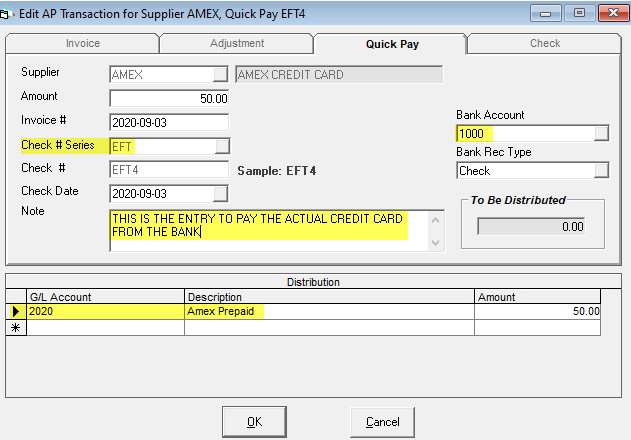

When the credit card statement arrives, enter an AP Quick Pay paying the actual credit card using either a real check (which you leave the check series to default to a regular check or by EFT check series, if you pay by EFT directly from your bank. This example is by EFT.

The two sides of this entry are the bank GL and the distribution to the prepaid parts liability GL.

Summary

With this process, you will see the parts inventory asset account recording the inventory value (cost for all inventory being costed at that time) properly.

When entering the supplier invoice as a Quick Pay during costing, the prepaid parts liability GL account will continue to increase by the dollar value of the supplier invoices.

When you pay the credit card, the actual bank is being used to pay the credit card properly, and you will see the prepaid parts liability GL account decrease by the amount you paid off on the credit card.

From month to month, you will be able to track the variance within the prepaid parts liability account; the amount costed on supplier invoice entries vs amount paid to credit card entries.

If a credit card statement shows $500 to pay but only $300 of supplier invoices were entered during costing, you know you have a $200 variance to investigate.